Table Of Content

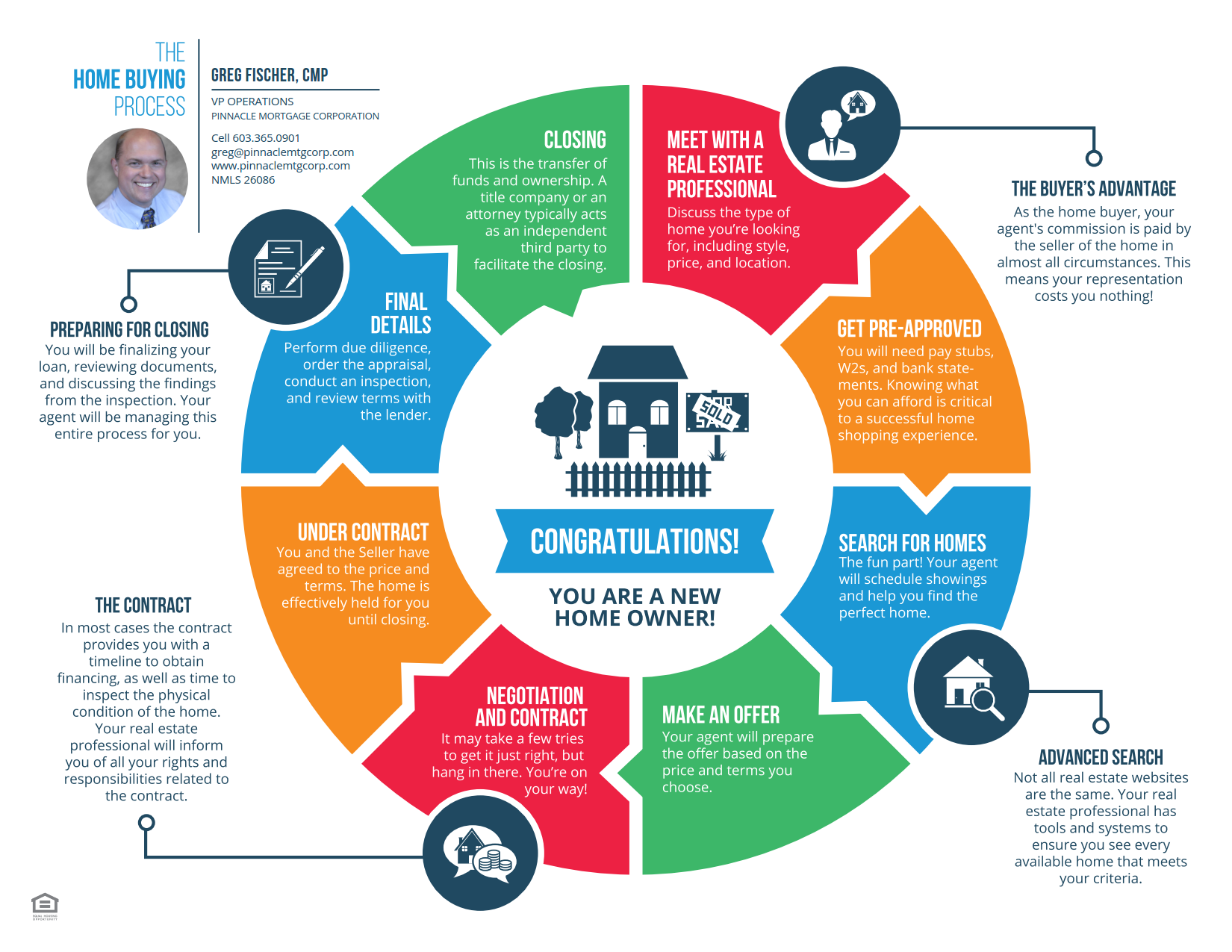

The more you know about the pros and cons of buying a house, the easier it’ll be to make the right decision for you. Now that you have a better understanding of the home buying process, let’s take a look at a few frequently asked questions about home buying. During a home inspection, an inspector will go through the home and look for specific problems. They’ll test electrical systems, make sure the roofing is safe, ensure appliances are working and more.

Explore loan choices

The higher your score, the lower the interest rate you will be eligible for — lower scores equate to more expensive mortgages. Because LA is such a complex market, it’s important to find a real estate agent who can help you make sense of the real estate scene. A local agent or Realtor will have a firm grasp of how quickly homes are going to contract, which areas are seeing more or less activity and when sellers might be close to dropping their prices. Once you’ve settled on a lender and applied, the lender will verify all of the financial information provided (checking credit scores, verifying employment information, calculating DTIs, etc.). Be aware that even if you have been pre-approved for a mortgage, your loan can fall through at the last minute if you do something to alter your credit score, such as finance a car purchase.

Bankrate logo

If you have excellent credit and a low debt-to-income ratio, some lenders will offer you conventional loan terms with a down payment of just 3 percent. However, it’s important to understand that a bigger down payment will make a huge difference in your monthly mortgage payment. An effective way to determine how much of a mortgage you might qualify for is to utilize a mortgage calculator.

Do a final walk-through

You may also be able to take advantage of down payment assistance or closing cost assistance programs as a first-time buyer. These programs, which can be operated by state governments and nonprofit organizations, can provide you with funding to cover your down payment and closing costs in order to make your home ownership dream a reality. Once the seller has accepted the offer, the earnest money will be deposited into an escrow account or held by the listing agent. Once the sale of the home has been completed, the earnest money you paid will be applied toward your closing costs. Counter-offers are common and should even be expected when buying a house. Common counter-offers can include proposed changes to the price, closing date, or purchase contract contingencies.

How much should I offer on a home?

While you might consider current mortgage rates ideal, you might benefit from waiting to build credit or saving for a bigger down payment. Speak with a lender or real estate agent before making the decision to buy this year or wait. Multiple people are involved when getting a mortgage and buying a house. As your representative in the home purchase transaction, your real estate agent will look out for your best interests by finding homes that meet your criteria.

How 9 homeowners bought their house, from loans to what to look for - The Washington Post

How 9 homeowners bought their house, from loans to what to look for.

Posted: Fri, 26 Apr 2024 12:06:46 GMT [source]

The impact of inflation and fast-rising interest rates dampened buyers’ interest, causing sales to slow and price appreciation to decelerate. You may also need to have cash reserves to help cover your mortgage in case of emergencies. These reserves are typically equal to at least 2 months’ worth of mortgage payments. Depending on the type of loan you’re applying for and your qualifications, your lender may require more months of payments. Working with an agent can help you navigate the real estate market, submit a legally sound offer and avoid overpaying for your property.

Hire a real estate agent

Read over your inspection results with your agent and ask whether they noticed any major red flags. If you’re on payroll, you’ll likely need to provide only recent pay stubs and W-2s. If you’re self-employed or receiving passive income like social security or pensions, you’ll need to submit your tax returns and other documents.

Welcome to Redfin’s First-Time Homebuyer Guide

It’s a good idea to make a list of your top priorities, some of which might depend on the type of house you’re looking for and whether you’re in search of a starter home or a forever home. As a buyer, you can usually work with a real estate agent for free. In most cases, the seller will pay the buyer’s real estate agent’s commission.

The median sales price of a single-family home in the Los Angeles metro area hit $750,000 in September (roughly double the national median), according to data from the California Association of Realtors. In fact, Los Angeles routinely ranks in the top 10 most expensive cities in the country, and even if you don’t live within the city limits, you’ll still have to deal with the high cost of living in the Golden State. Beaches, mountains, cosmopolitan energy, cultural institutions and a thriving food scene, all dusted with Hollywood-style sophistication and glam – there are so many reasons to love living in Los Angeles. Plus, the city is making a name for itself in the high-tech industry.

Your agent will have additional comparable homes for your consideration when appealing the value from the appraisal. It’s common for home buyers to include a home inspection contingency in their purchase offer. A contingency gives buyers the option to back out of a purchase (or negotiate repairs) without losing their earnest money deposit if the home inspection reveals major issues. When you decide to make an offer on a home, you must submit an offer letter. Your agent will almost always write the offer letter on your behalf, but you can write it yourself if you choose.

Keeping a monthly budget can help you stay on top of your mortgage and other costs, while taking care of your home over the long term. Buying a new home is a complex undertaking, even if you’ve been through it before. Explore our easy-to-follow home buying checklist to understand the process. Apply online for expert recommendations with real interest rates and payments. Walk through the home and make sure the seller hasn’t left any belongings.

Homeownership costs extend beyond down payments and monthly mortgage payments. Let’s now go over some final tips to make life as a new homeowner more fun and secure. You don’t want to get stuck with a money pit or with the headache of performing a lot of unexpected repairs.

How real estate commission changes could affect buyers and sellers - The Washington Post

How real estate commission changes could affect buyers and sellers.

Posted: Thu, 25 Apr 2024 14:00:00 GMT [source]

Based on your preapproval letter, your real estate agent can help you find homes within your budget. Other closing costs can include loan origination fees, title insurance, surveys, taxes, and credit report charges. Most offers also contain an earnest money deposit, typically 1% – 3% of the purchase price, which shows the seller you’re serious about purchasing. Your real estate agent can tell you what’s common in your market. Your earnest money deposit goes toward your down payment and closing costs if you buy the home.

Whatever the economic state of the real estate market, buying a house can be an exciting and emotional process. Before starting your search, be sure you understand the ins and outs of homebuying, so you can make the best decisions for your family — and your wallet. And now, in 2024, inflation is much lower but home prices and mortgage rates are both still high. Sellers still have an edge in many areas, thanks to a continued scarcity of houses, and no one expects a dramatic housing market crash. Still, many analysts see a shift coming toward a more balanced market, which would benefit buyers. The credit score required to buy a house depends on your lender and the type of loan you’re taking out.

The beauty of southern California is offset by some serious risks. Nearly one in every four properties faces a heightened hazard of flood damage, and wildfires continue to threaten the area year after year. As you’re thinking about buying a home here, it’s important to calculate how much you’ll need to pay in homeowners insurance coverage to protect it, and if additional insurance, like flood insurance, is mandated. Additionally, it’s important to note that a statewide shift away from a seller’s market is already happening. The median time a home spent on the market in the LA metro area was 23 days in September – a sizable jump from 10 days just one year earlier. Plus, Redfin data shows that the percentage of sellers in the area who have dropped their prices has been increasing since February.